2023 10 19

Fixed-income investments as a priority for Q3, 2023

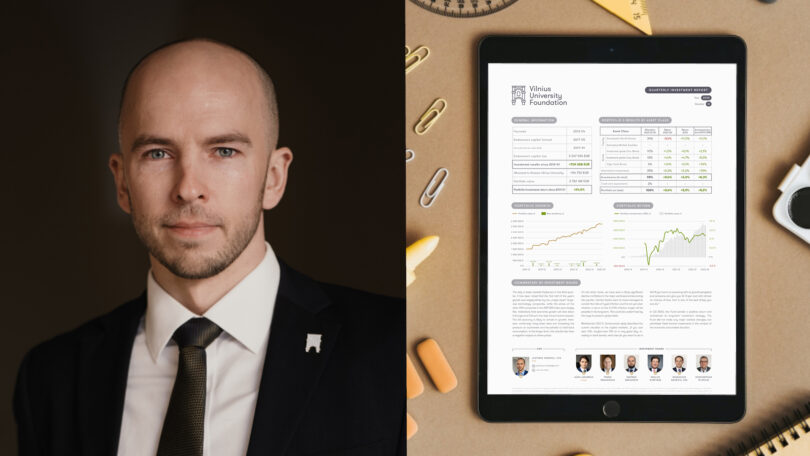

The VU endowment fund announces its investment management results for Q3, 2023. According to the Investment Board, the Foundation earned a positive return and maintained its long-term investment strategy, did not make any major tactical changes, but prioritised fixed-income investments in the context of the economic and market situation.

"The rally in stock markets fizzled out in the third quarter. It has been noted that the first half of the year‘s growth was largely driven by the „magic seven“ large-cap technology companies, while the prices of the other 493 companies in the S&P 500 index were largely flat. Indications that economic growth will slow down in Europe and China in the near future have increased. The US economy is likely to remain in growth", noted in the commentary by the Investment Board.

View as PDF here.

Members of the VU Foundation's Investment Board, responsible for professionalism and performance: Alius Jakubėlis (Chairman), Šarūnas Barauskas, Mindaugas Mažeikis, CFA, prof. Konstantinas Pileckas, Paulius Kunčinas, and Tomas Krakauskas.

_

Read more about VU Foundation Investment strategy.

More news

2025 06 30

M. Juozapavičius And Prof. E. A. Janulaitis Have Been Named Patrons Of Vilnius University

See more

2025 06 20

Returns from Named Sub-Funds Pave the Way for New Endowed Scholarships and Awards

See more

2025 05 08

Janina Muraškienė Donates €100,000 to Empower Talented Scientists to Change the World

See more

2025 03 27

Valauskas Sub-Fund Scholarships Awarded, Honorary Wall of Patrons Unveiled at VU Faculty of Medicine

See more