Allocating 1,2 % PIT to the Fund & Sub-funds

Support the Vilnius University Foundation without any additional expenses! Until May 2, allocate 1.2% of your PIT (personal income tax) to us. The received support is invested. We use investment returns to finance scientific talents at Vilnius University!

Every year, approximately ~20 million EUR of the 1.2% PIT support remains undistributed. From the average wage (1.9k EUR per month), the 1.2% PIT portion is about 50 EUR (from 2.5k EUR → 70 EUR; from 3.5k EUR → 100 EUR). In just 2 minutes online, fill out the support form and contribute to the future of education and science in Lithuania.

If you have already allocated 1.2% PIT support to the VU Foundation for several years ahead, there is no need to fill out the forms again, thank you!

Note: The following 3 steps are only available in Lithuanian language. After the 3rd step, you will be able to switch the language to English. Sorry for the inconvenience.

1. Log into → ELECTRONIC DECLARATION SYSTEM (EDS).

When connecting via online banking, select the section ‘VMI electronic services’, look for ‘Connect to EDS’.

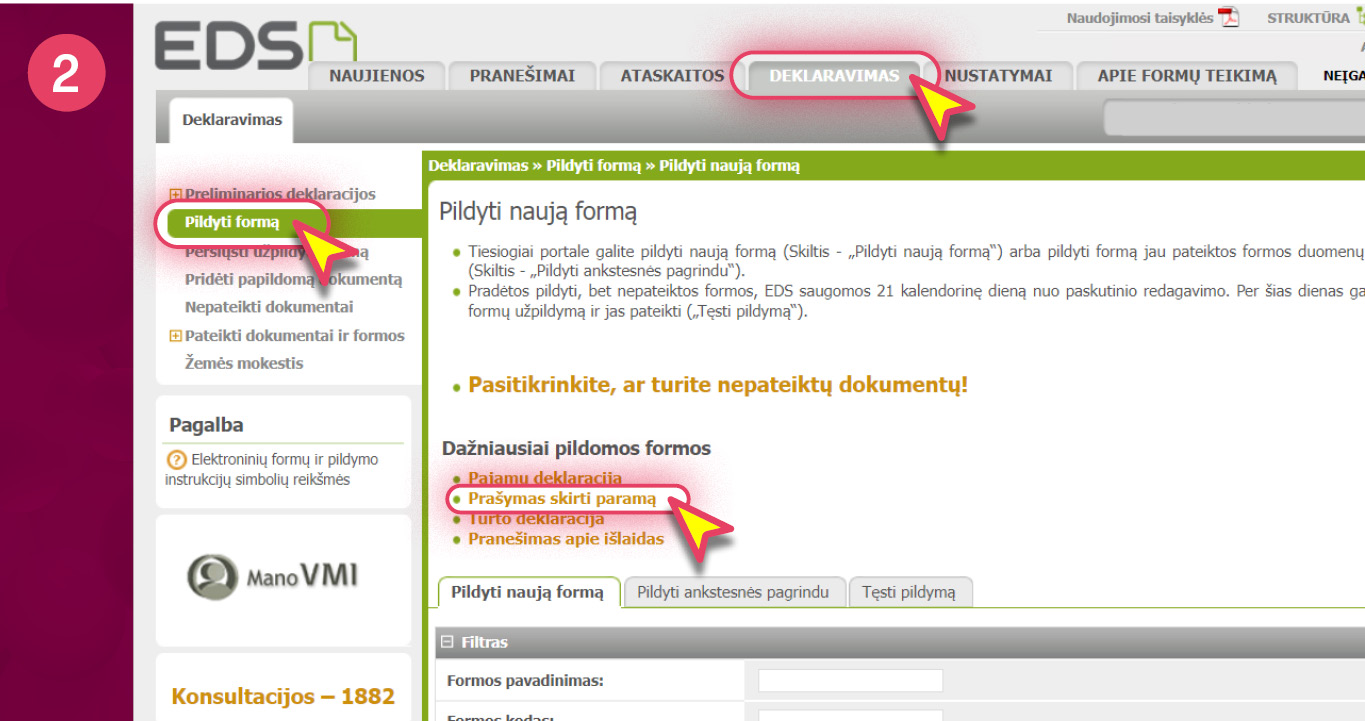

2. Look for PRAŠYMAS SKIRTI PARAMĄ. Make sure DEKLARAVIMAS is selected at the top; PILDYTI FORMĄ on the left; PRAŠYMAS SKIRTI PARAMĄ in the middle.

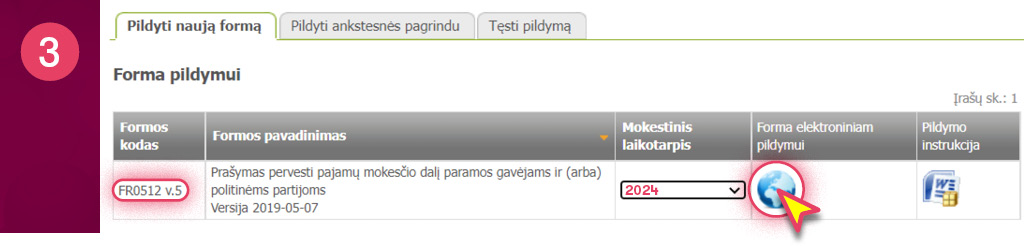

3. Start filling out form FR0512 directly on the portal. Click on the GLOBE icon.

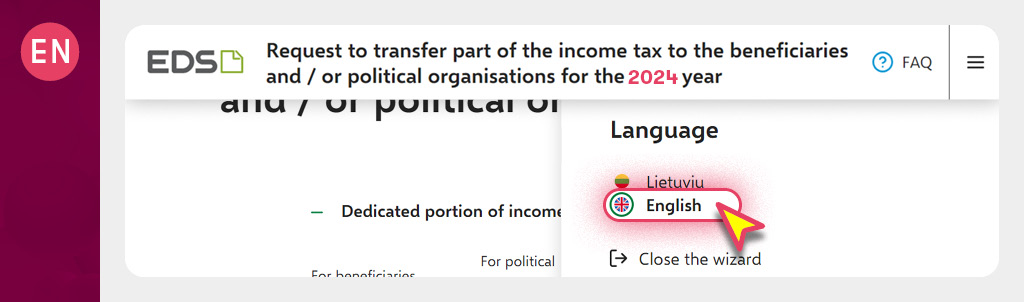

Important: now you can switch the language to English.

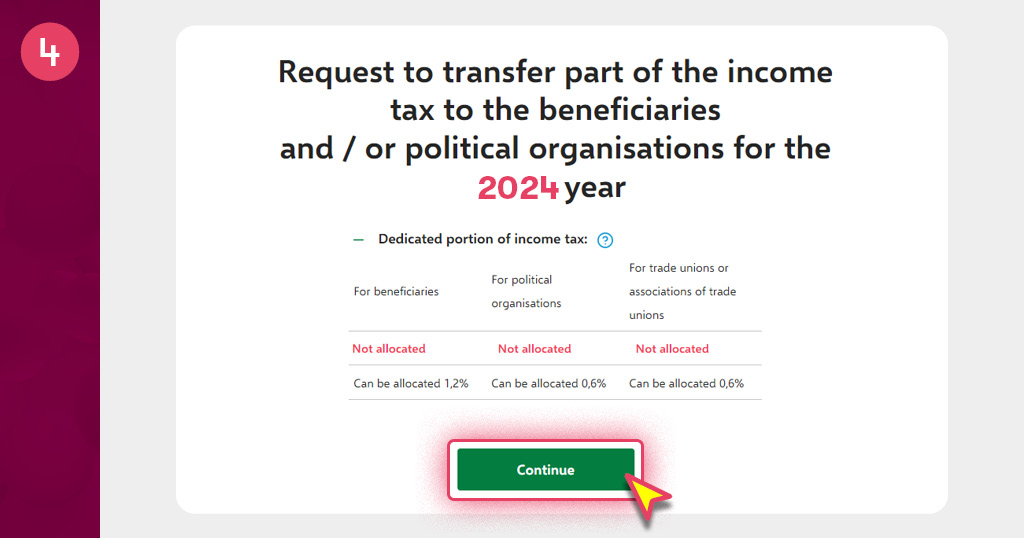

4. The online guide will assist you in filling out the form. If support for the 2024 tax period was not (or was) allocated, click CONTINUE (or START).

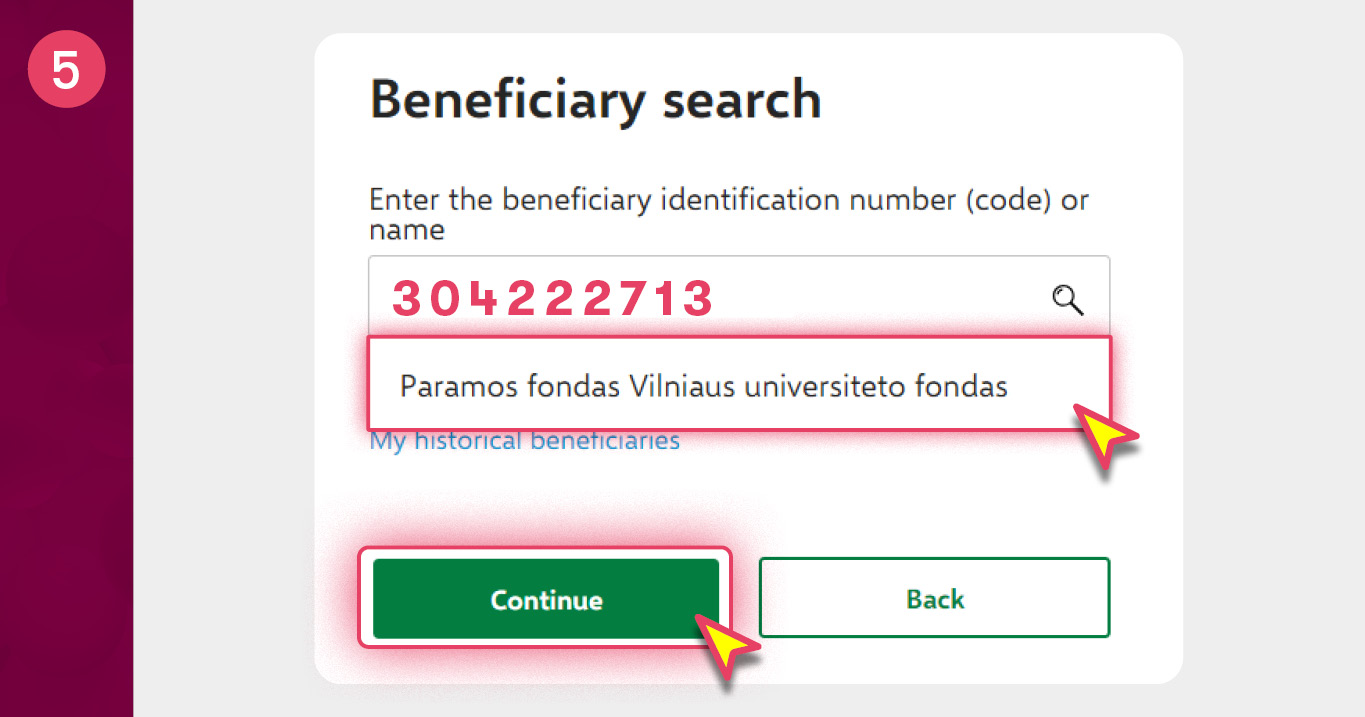

5. In the recipient search window, find “Paramos fondas Vilniaus universiteto fondas”. In the search field, enter our identification number 304222713 or the name.

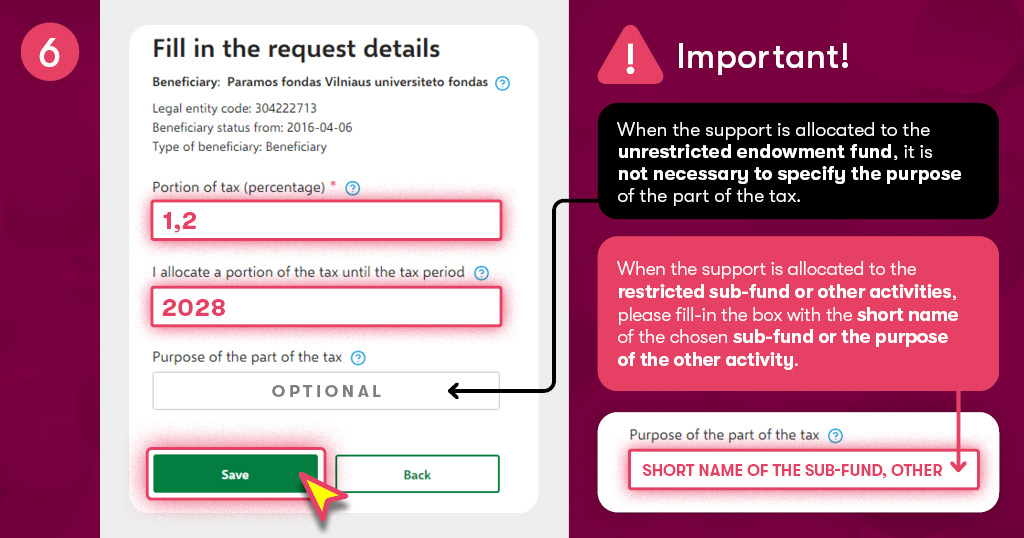

6. Portion of tax: 1,2. Tax period: 2028. When the support is allocated to the unrestricted endowment fund, it is not necessary to specify the purpose of the part of the tax. When the support is allocated to the restricted sub-fund or other activities, please fill-in the box with the short name of the chosen sub-fund or the purpose of the other activity.

When the support is allocated to the restricted endowment sub-fund, please fill-in the box with the short name of the chosen sub-fund:

|

Sub-fund |

Short name |

|---|---|

| VU IIRPS Sub-fund | |

| VU LSC Sub-fund | |

| VU MF Sub-fund | |

|

VU Faculty of Economics and Business Administration Endowment Sub-fund |

VU FEBA Sub-fund |

| VU MIF Sub-fund | |

| VU LF Sub-fund | |

| VALAUSKAS Sub-fund | |

| VU MUSEUM Sub-fund | |

| ARIMEX Sub-fund | |

| VU KNF Sub-fund | |

| VU ZOO MUSEUM Sub-fund | |

|

Prof. Algis Petras Piskarskas (1942-2022) Endowment Sub-fund |

PISKARSKAS Sub-fund |

| J. KAZLAUSKAS Sub-fund |

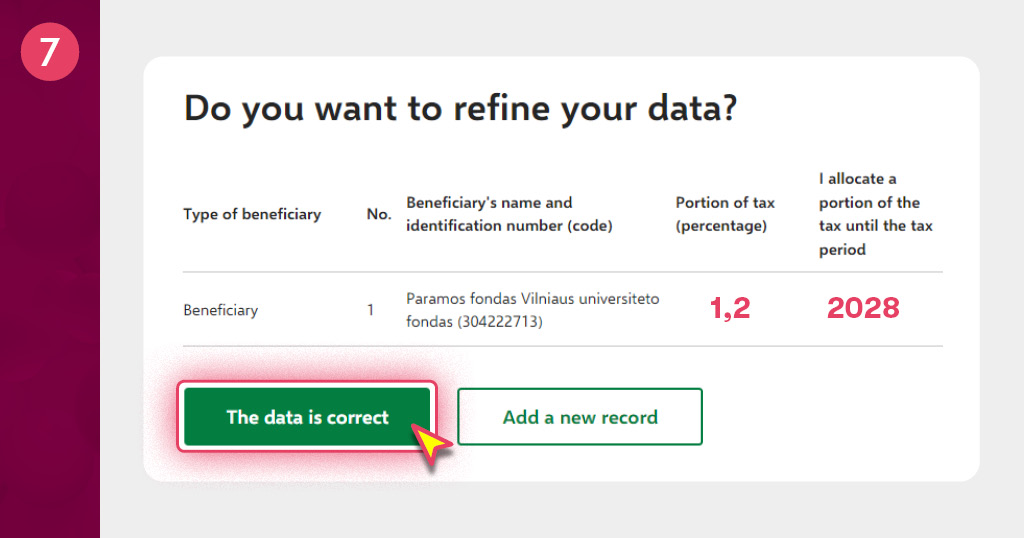

7. Confirm that the entered data is correct.

8. Form a request.

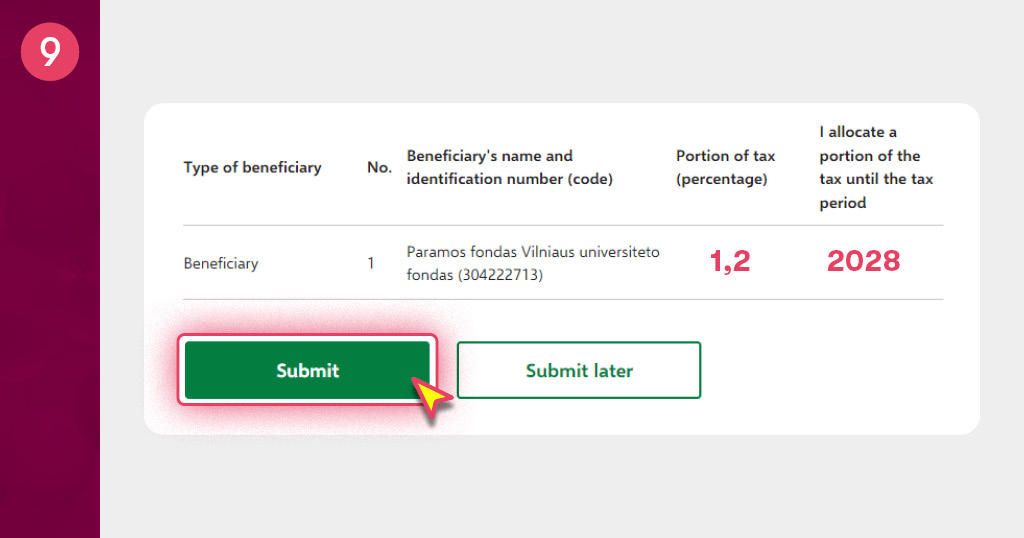

9. Submit the request.

Share the invitation to allocate 1.2% PIT to the VU Foundation on social media:

Most frequently asked questions:

- Want to allocate the 1.2% PIT support to multiple recipients? No problem! You can divide your 1.2% into several parts, for example, allocate 0.6% to the VU Foundation and the remaining 0.6% to another recipient.

- Have you already allocated 0.6% to a political party or trade union? Not sure if you can allocate 1.2% to other recipients? Yes, you can! These percentages are not divided among themselves. Each taxpayer can allocate 1.2% to recipients (such as the VU Foundation), 0.6% to political parties, and 0.6% to trade unions or associations.

- Can Vilnius University (company code 211950810) receive a 1.2% personal income tax (PIT) donation? Unfortunately, Vilnius University does not meet the criteria for PIT support (it does not have NGO status) and, therefore, will not be eligible to receive GPM donations from 2025. We invite you to direct your GPM support to the VU Foundation (company code 304222713).

- Don’t want to fill out the 1.2% PIT form every year? Allocate support until the 2028 tax period and don’t worry about filling out or adjusting the form for 5 years.

- Do you have any questions? We are happy to answer them and assist you in filling out the form. Get in touch.